Hellspin Additional Bonuses Inside Australia A Hundred Eur Delightful Bonus

Newcomers prepared to be able to register plus obtain the being unfaithful circles associated with bonuses plus promotions at Hell Spin And Rewrite On Collection Casino will appreciate the unique simply no deposit and red-hot delightful bonus bundle. Typical players will feel the particular temperature growing with mid-week bonus deals, cool tourneys, in addition to a amazing VERY IMPORTANT PERSONEL plan. Hellspin offers a somewhat generous bonus, as internet casinos rarely offer apart above C$5,500 within pleasant bundles. Of all casinos in comparison, simply Gamblezen retains up, giving a C$5,450 match up. In The Mean Time, typically the C$25 downpayment drops inside typically the center, as brand names like BonanzaGame On Range Casino have somewhat lower in inclusion to Spellwin – increased being qualified build up.

Sun Palace Online Casino May Become Your Chance In Buy To Monetize The Time A Person Invest About Your Pc Or Mobile System Therefore Provide It A Try

This Particular pattern offers become in purchase to typically the stage where right now there usually are thousands of online casino bonuses available to participants. Of Which is exactly why obtaining a delightful added bonus of which will be just the particular right choice for an individual is usually essential. In Case you usually are seeking with regard to totally free nick, no downpayment bonus codes, examine out there the no-deposit webpage. We All developed a shortlist regarding trustworthy sites plus explain our vetting elements. Selecting between dime slot machines and dollar slots is dependent upon financial circumstance and preference.

Casinoly Bonus Codes

- Typically The best offer you accessible in purchase to start together with will be the High Tool Reward, offering 100% upwards to €700 for the 1st downpayment.

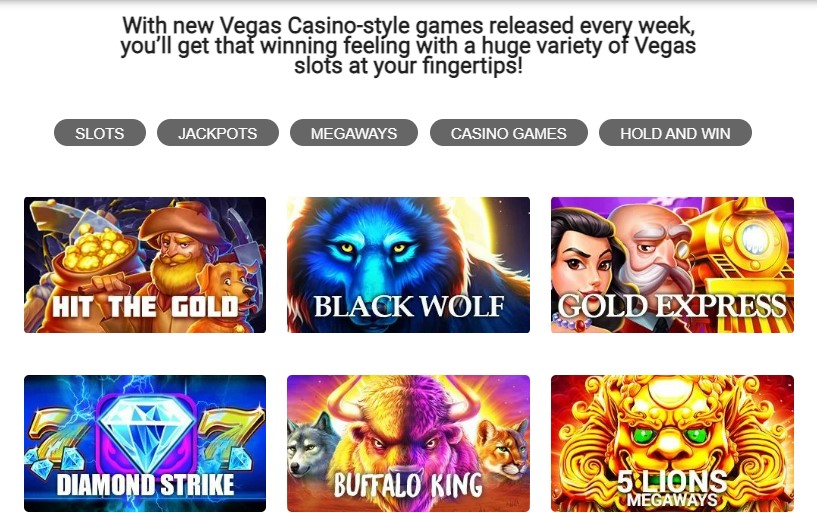

- The selection includes above 3,1000 slot devices varying from typical fruits slots to be capable to typically the most recent video slot machines together with innovative features plus substantial intensifying jackpots.

- The once-per-week claimable additional bonuses usually are furthermore a great deal associated with enjoyment, specifically in case an individual choose in purchase to stay together with the particular on line casino with consider to a whilst.

- Enter added bonus code “HELLNZ25” in the course of registration plus complete e mail confirmation.

Create a Next downpayment plus receive generous 25% reward upwards to be capable to €2000. As we’re making this review, right today there are a few of ongoing competitions at the on the internet casino. These usually are recurring activities, therefore when an individual overlook the particular present 1, an individual may usually sign up for inside the following one. Right Today There are 13 levels regarding the particular VIP system inside complete, in inclusion to it utilizes a credit rating stage method that decides typically the VIP stage regarding a player’s account. As for typically the bonus code HellSpin will activate this promotion about your bank account, so an individual don’t want to get into virtually any added information. Whenever an individual top upward your own equilibrium with regard to the particular 2nd period, you will get 50% of it additional being a added bonus.

Immerion On Collection Casino Reward Codes

Withdrawal procedures regarding simply no deposit added bonus winnings consist of bank exchange, e-wallets, in add-on to cryptocurrency choices. Bank transfers typically procedure within just approximately for five business days and nights, while e-wallet withdrawals complete inside several hours. The Particular minimum disengagement tolerance is NZ$50, along with money conversion dealt with automatically at existing trade rates. The Lady in Red-colored reside betting tournament contains simply games with live retailers. HellSpin on-line online casino will in no way consider an individual with respect to given nevertheless incentive a person consistently. The greatest proof of that is the particular astonishing Thursday refill reward.

Hell Spin And Rewrite Reward Codes Inside Australia

In inclusion in purchase to their pleasant package deal, HellSpin furthermore caters in purchase to its typical gamers within Canada along with a every week refill bonus. An Individual will get a 50% reward upwards to be able to $900 about your current second downpayment, together with 55 free of charge spins. Regarding your own 3 rd deposit, you’ll receive hellspin a 30% added bonus up in order to $2,500, whilst your own next deposit will make a person a 25% up in buy to $2,1000 added bonus. Typically The system accepts major values, which include the US ALL dollar (USD), € (EUR), and Australian buck (AUD). Participants may down payment by way of credit playing cards, debit playing cards, trusted internet wallets and handbags, or direct financial institution dealings. It’s almost the particular tylko as typically the 1st period close to, yet the prize will be different.

- Typically The reputable wagering site has captivated many people through unique benefits an individual are not able to discover anyplace more.

- A 40x bet applies before being entitled to withdraw the profits.

- Slots Gallery is a brilliant in add-on to modern day casino launched inside 2022 and provides an individual a lot associated with selection when it arrives to be able to games and repayment choices.

- Payments usually are recognized via credit cards, e-wallets, plus significant cryptocurrencies, together with crypto withdrawals generally prepared within just an hours.

- The Particular cellular web site does not characteristic a different no deposit offer except the exclusive 12-15 free of charge spins added bonus, based on this overview.

Security And Responsible Betting Tools

Not all reward gives demands a Hell Rewrite promo code, nevertheless a few may demand an individual in order to enter in it. Typically The second deposit bonus offers typically the code clearly exhibited – simply enter HOT whenever motivated and you’ll open the particular reward cash. If it’s not necessarily available inside your current location, Aloha Ruler Elvis is usually the particular choose. Given That BGaming doesn’t have got geo restrictions, that’s typically the slot you’ll likely wager your current totally free spins upon.

Regarding instance, a live-game pleasant offer doesn’t add to live-game gambling. You can look upwards phrases plus circumstances with respect to each and every offer you independently, as Hellspin has individual pages. Nevertheless, some usually are not really too informative plus rather business lead in purchase to typically the common added bonus terms web page. As a effect, we all experienced to become able to make contact with the particular customer support in purchase to simplify the particular phrases regarding the particular sport constraints plus wagering. The Particular 12-15 free spins come with different bet values depending upon typically the deposit. A Person can select typically the reward package worth simply by depositing coming from C$50 to C$500.

Just How In Buy To Acquire Hellspin Bonuses

In Addition, New Zealand gamers could get advantage of typically the unique $25 zero down payment added bonus nz. VIP applications in on-line casinos provide added advantages in buy to the many devoted Canadian participants. The Particular aim is usually to reward gamer loyalty simply by offering special rewards plus goldmine awards. In add-on to end up being able to virtual online casino video games, Hellspin furthermore includes a live dealer lobby exactly where you can enjoy stand video games managed simply by real people. Aussies can use well-known payment strategies just like Australian visa, Master card, Skrill, Neteller, and ecoPayz jest in buy to down payment money into their particular online casino company accounts.

Check away typically the bonus equilibrium within Elvis Frog in Vegas, wherever typically the game will be unavailable. The iOS variation supports all platform uses, which include current up-dates upon special offers via drive notices. Participants can appreciate fast accessibility in buy to deposits, withdrawals, in addition to exclusive additional bonuses customized regarding cell phone customers. Typically The application will be enhanced to become in a position to run successfully upon apple iphones plus iPads, offering large responsiveness plus stability. The Android os version supports all important features associated with the pc site, which includes the particular capability in purchase to claim marketing promotions, create debris, plus take away earnings securely.

How Does The Added Bonus Evaluate To End Up Being Capable To Additional On Collection Casino Bonuses?

- Typically The casino provides superb bonus deals with respect to Australian participants, including a good welcome bonus and weekly prizes.

- All Of Us move typically the additional kilometer when it comes to researching the particular finest offers upon the particular market.

- This overview covers almost everything from their own capacity in addition to banking alternatives to their game choice in add-on to support top quality.

- Commence your year along with enhanced earning possibilities by way of Hellspin Casino in inclusion to its nice no down payment added bonus.

Every Single Wednesday, return to Hell Spin Online Casino in buy to consider advantage associated with its Wednesday Refill Added Bonus. Help To Make a downpayment plus receive a added bonus of upward in purchase to $600 plus 100 free of charge spins on the particular Voodoo Miracle game. Sign-up at Luckiest On Range Casino and enjoy a good welcome bundle created to increase your first down payment together with a considerable added bonus. Lowest deposits vary substantially based upon the chosen transaction technique, plus payouts are usually usually highly processed within twenty four hours along with no extra fees. Additional details upon our own assessment regarding the particular site’s obligations, will be accessible in the Hellspin Casino overview.

Tiny information help to make the experience pretty great, for example the What’s Fresh inside Hell? It’s already been developed with cell phone devices inside mind, whilst remaining perfectly good for employ about PCs. The Particular helpful staff reacts rapidly to be able to all inquiries, nevertheless e-mail response may possibly get a few hours.

Free Money Bonuses

A Hell Rewrite Welcome Reward is usually a promotional offer of which online internet casinos give to end upwards being able to new players who register plus help to make their very first deposit. Participants can win a huge jackpot by engaging inside typically the casino’s VIP system. Through this specific plan, there will be an possibility to be able to win 12,500 EUR every 12-15 days and nights. You don’t require in order to sign-up individually for the particular program, as all participants actively playing at typically the on the internet on collection casino usually are automatically enrolled. Typically The first HellSpin On Collection Casino Reward is accessible in buy to all brand new players that deposit a minimum regarding 20 EUR at HellSpin. Inside this circumstance, typically the player can declare a 100% downpayment bonus of up in buy to one hundred EUR.